A review: Barry Kloogh's The Money Cookbook

The disgraced architect of a ponzi scheme was also a published writer

Welcome back. I’ve had a great holiday, and here are some quick highlights.

Visit:

If you are ever looking for somewhere different to stay, I thoroughly recommend Wonderland in Makarora, about a four hour drive from Dunedin (an extra 30 minutes if you stop at Jimmy’s in Roxburgh…).

A-Frame cabins = A+ accommodation.

Some great walking tracks nearby, including the famed Blue Pools. Magic.

My family largely stayed at home this summer after a hectic December, and Dunedin turned on the weather.

May favourite spots around the city include Victory Beach and Aramoana (particularly when a cruise ship is nearby).

While Victory Beach has become more widely known for its pyramids, I went with my boys to find the wreck of the SS Victory, which was shipwrecked in 1861.

At low tide you can get a pretty good view of parts of the wreckage, which is the only visible remains of the steamer since it ran aground 162 years ago, due to a drunken sailor being left in charge.

‘‘So slight was the shock that a cup of coffee in the hands of a passenger was not spilt,’’ The Lyttelton Times reported.

I found an 1861 auction listing for some of the cargo, which included:

16 quarter casks of brandy

39 bales - and a bag - of wool

300 tonnes of coal

Wines/ales/preserved meat

Various parts of the ship, including the anchor,

and cabin items, including sugar tongs, nut crackers, punch ladles, decanters, ivory and bone-handled carvers.

I love how the auction company put on a boat from Steamer Basin to Portobello, with the items all auctioned off at the site of the wreck with the bonus of ‘‘substantial refreshments provided’’.

It is worth the trek.

To watch:

My favourite moment was watching an enormous sea lion emerge from the waves just as my eldest went to surf for the first time.

Read:

My summer reading included The Heretic by Dunedin’s own Liam McIlvanney. A brilliantly written crime caper/tartan noir.

Recommended.

And I was surprised to spot my name in the acknowledgements. Thanks Liam!

Another book I read - or rather, hate read - featured this quote on the cover:

“This is a book for those who want to know exactly how to invest so every dollar is constantly working to help you grow your wealth!”

It is attributed to ABGT Radio, which does not appear to be an actual radio station but an electronic act with a two-hour weekly show.

You can listen to them here:

But I digress.

The quote is from The Money Cookbook.

The book, which I bought online from Amazon, says it is:

“A modern recipe to organising your cash and building wealth.”

Fair enough.

And it is written by none other than former Dunedin-based disgraced financial advisor: Barry Kloogh.

You may remember Kloogh from such stories as:

Failed financial adviser Barry Kloogh jailed for nearly 9 years for $16m ponzi scheme

Convicted fraudster Barry Kloogh appeals jail sentence for ponzi scheme

and

Widow and factory worker lost a fortune to ponzi schemer Barry Kloogh.

I’ve been meaning to read the book for a couple of years, and this summer I finally got a copy for my Kindle ($NZ11.34).

I’ve been interested in reading it since reporting that the book was used by Kloogh to lure prospective clients for his financial services. Kloogh also used free tickets to musical theatre productions, and it is a good time to reintroduce readers to Barry Kloogh starring as Rene from Allo Allo.

The 54-page book was published just over a decade ago, which is less than the jail sentenced handed down to Kloogh on December 15, 2020.

He was jailed for eight years and 10 months, with a minimum non-parole period of five years and four months.

That means he will be eligible for parole in a few years, a double blow for the dozens of victims who lost more than $15.9 million. Very little of that amount is expected to be clawed back.

But I digress. Back to The Money Cookbook.

Like many good crime capers - sorry, I mean financial advice books - it has a killer intro:

“Barry Kloogh is a leading authority on personal and organisational wealth management, the CEO of Financial Planning Limited and the founder of Strategic Wealth Made Simple.”

Fact check: His Dunedin-based company was raided in May 2019 by the Serious Fraud Office. It was found he operated a ponzi scheme. While that scheme may have been operating for two decades, investigators concentrated on the period since 2012 - the same year The Money Cookbook was published.

But I digress.

Helpfully Barry Kloogh addresses the reader directly, urging them that if they are “getting lost while reading these chapters”, they should email him directly.

So I did.

I didn’t get a reply.

But I digress.

Barry Kloogh quickly explains that The Money Cookbook references his two passions: money and cooking.

“Good cooks know that you’ve got to start with a really strong recipe as part of a great menu,” Kloogh writes.

“Food and money are both cornerstones of a healthy life. You need to eat well and you need to spend and invest money wisely too.”

Fact check: Food is important, and yes, spending and investing is also important. But just in case you forgot, Kloogh ran a ponzi scheme.

“Such schemes generally collapse when the operator can no longer find sufficient new funds to satisfy the existing investors,” the first report (2019) from liquidator New Zealand Insolvency and Trustee Service said.

But I digress.

In The Money Cookbook, Kloogh stresses the importance of financial planning, foreshadowing that: “Too many people, who lost money on their investments, simply didn’t think they were going to have the disasters that occurred”.

Fact check: True. All of Kloogh’s clients were blindsided by his ponzi scheme. They trusted him with their life savings as he prepared to buy one of Dunedin’s grandest home, leased late model European cars and travelled overseas on their dime.

A large part of the book is devoted to a questionnaire, where people (helpfully for Kloogh) would list their assets/liabilities and insurances.

He also provides some advice on how to select the right financial adviser.

“Think of your financial adviser as your partner. You need an expert. You need someone, who will look out for you and set you in the right direction.”

Tell me more, Barry.

Spoiler alert: he does, in one of the more galling passages of this book.

“Trust! This is one of the most important qualities you want. Managing your finances is very important to you, so you’ve got to trust your adviser.”

Fact check: After Kloogh’s guilty plea, Serious Fraud Office director Julie Read said he had “exploited the trust and goodwill of his clients to misappropriate a significant amount of money from them”.

“Many victims lost their retirement savings and are not in a position to recover financially,” she said.

But I digress.

Kloogh, disingenuously, writes that when you’ve selected your financial guru. Put. It. In. Writing.

“By creating a written document, you are making yourself and your adviser accountable.”

Fact check: *Exhales loudly* Kloogh told clients their money had gone to a third-party investment platform, but instead he changed the trading name of his bank accounts to make it appear they were owned by another entity.

He would then use the series of renamed accounts to transfer money between himself and clients.

But I digress.

Three quarters of the way through the book is another ‘client profile questionnaire’, Wait, I’m a client now!?

That ‘questionnaire’ asks ‘clients’ the sort of risk they would be prepared to stomach (my own cooking analogy!) and their attitude to savings/investments.

After the ‘questionnaire’, the book takes an unexpected turn.

“Congratulations,” it says.

“Your future is already changing. The clarity you’ve gained through the previous pages is a great first step . . . now the exciting part begins.”

Did I miss something? Wait for it. Wait for it.

“If you want me to personally help guide you . . . contact my office now at . . . .”

The same email was listed, I’ve still not received a reply, and the three numbers for the UK, the US and NZ went nowhere.

Fact check: The only clarity I gained from this book was reading the misguided writing of a charlatan. Kloogh is too lazy to continue with his cooking analogies and he basically ignores them after a few awkward pages at the start and end of the book.

But I digress. And wait, there is more.

Kloogh writes how he would pick up mistakes on his phone bill/credit card and “While the amounts may be small, they all add up”.

Kloogh also writes (I urge you to read this in the voice of Rene from Allo Allo) where he sources his financial news in order to stay ahead of the markets.

“I also watch Fox Business News every morning and night so I get an idea of what’s happening around the world”

Incredible.

“Each part of this book, each chapter, is like part of a recipe,” Kloogh writes in one of the closing pages.

“When you put these basic ingredients together, as simple as they may sound, they can make a delicious meal.”

I had trouble digesting that waffle.

But it gets worse. Much worse.

“The people who stop their education before learning how to handle money are the ones who end up dead broke or dead before their expected lifespan.”

Fact check: Barry Kloogh was declared bankrupt on November 18, 2019.

But I digress.

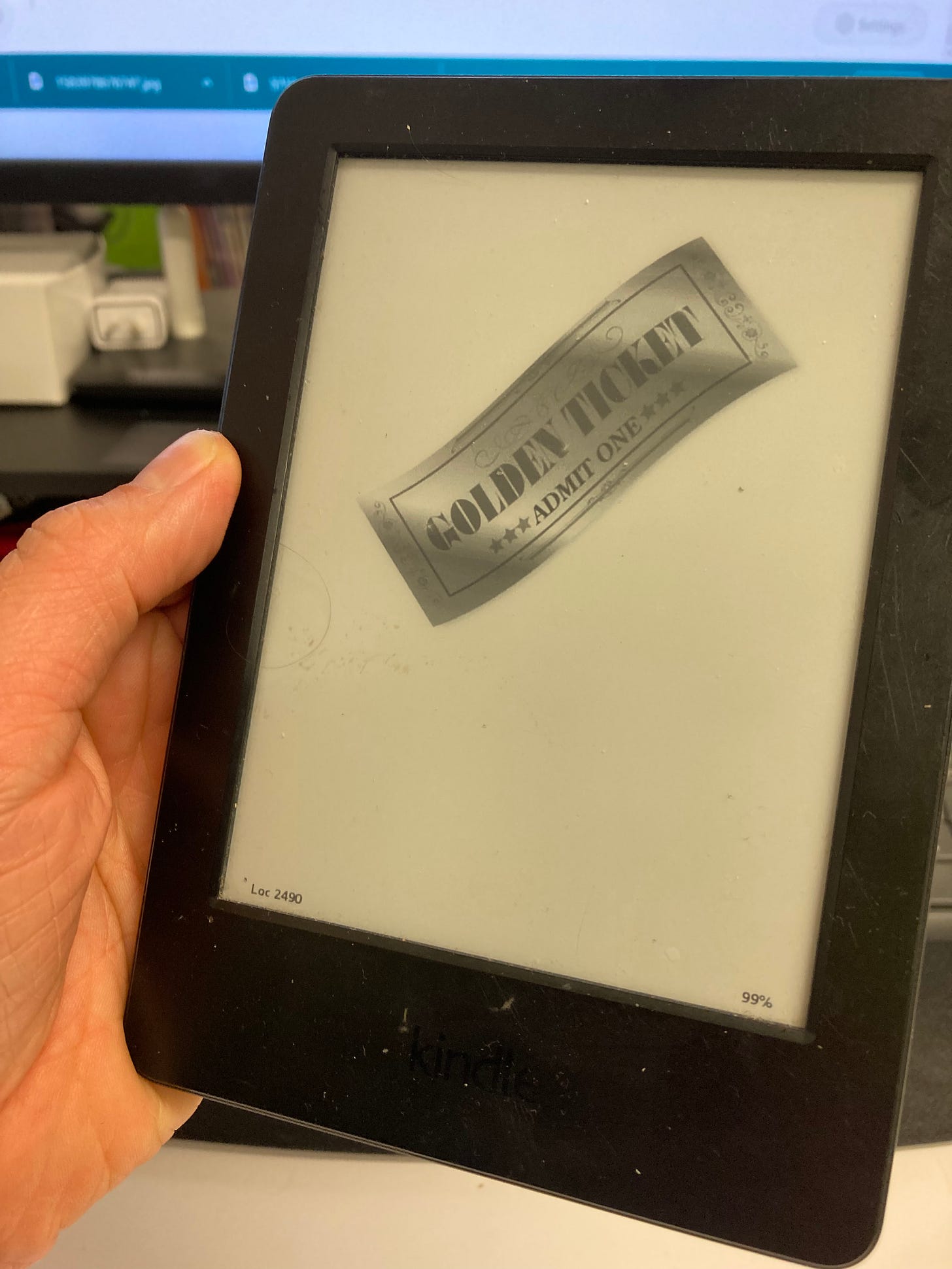

And the book ends (thankfully) with the single clip-art image of a ‘Golden Ticket’ which simply reads ‘Admit One’.

That ‘Golden Ticket’, dear reader, allows you to redeem your free access to Kloogh’s online wealth seminar, however the website no longer exists.

Plot twist!

I gave the book a one star review. And I’ll never get that money back, just like many who crossed Barry Kloogh.

Now it is time for Tweet of the Week:

I can see my house!

Also worth a follow is this account, featuring many stunning ye olde photographs from around Dunedin:

This time next week Forsyth Barr Stadium will be getting ready to host the Red Hot Chili Peppers, but the more interesting gig happens this Friday with The Puddle set to play at The Crown.

This is probably the band’s best album. Enjoy.

Victory Beach, didn't realise the wreck was still visible, need to factor that in next time we walk there. Last time the kids really enjoyed looking for shells. Having grown up with Kaka Point as my beach, I do find the lack of shells on the central city beaches disappointing.