I’m trying to write this newsletter while I await the verdict of the Rosemary Penwarden case, which effectively involved a letter sent to delegates of a petroleum conference. Her side is arguing that it is satire, while the other is arguing the intent was to cause disruption through the forged letter.

A jury will decide this one (and here is the result!). As an aside, when reporters are offsite we await for an email telling us the jury has reached a verdict. It is a mad rush to get your gear, head to court, find a park, and set up your laptop.

Often when the jury return you can feel the atmosphere of a court change immediately, particularly in a high profile case.

I’m always fascinated by the reaction of the jury, many of whom struggle to make eye contact with the person awaiting the verdict. It really is high drama.

On the subject of a jury, a quick poll to kick things off this week.

Earlier today I sat down with Stephen Anderson.

He is a person I wrote a story about last week, but couldn’t track down. But because of that yarn, he found me. Perfect.

That story was well read, this is it here:

Long-running legal case over the mortgagee sale of a family farm finally over

It has all those elements that make it of interest to readers, but it just lacked one crucial aspect: the human element.

Well, here it is.

On court documents, Stephen Anderson lists his occupation as a Wanaka farmer.

“That’s what I am. They just took my land off of me.”

The 68-year-old was the fourth generation of his family to live on their farm near Wanaka.

But in the space of a couple of years, he lost it all.

His marriage. Over. His finances, in ruins. And then they came for the family farm: a 669 acre property at Mt Barker.

Anderson went bankrupt in 1987 on the advice of his lawyer.

“They didn’t force me into bankruptcy, I did it myself.”

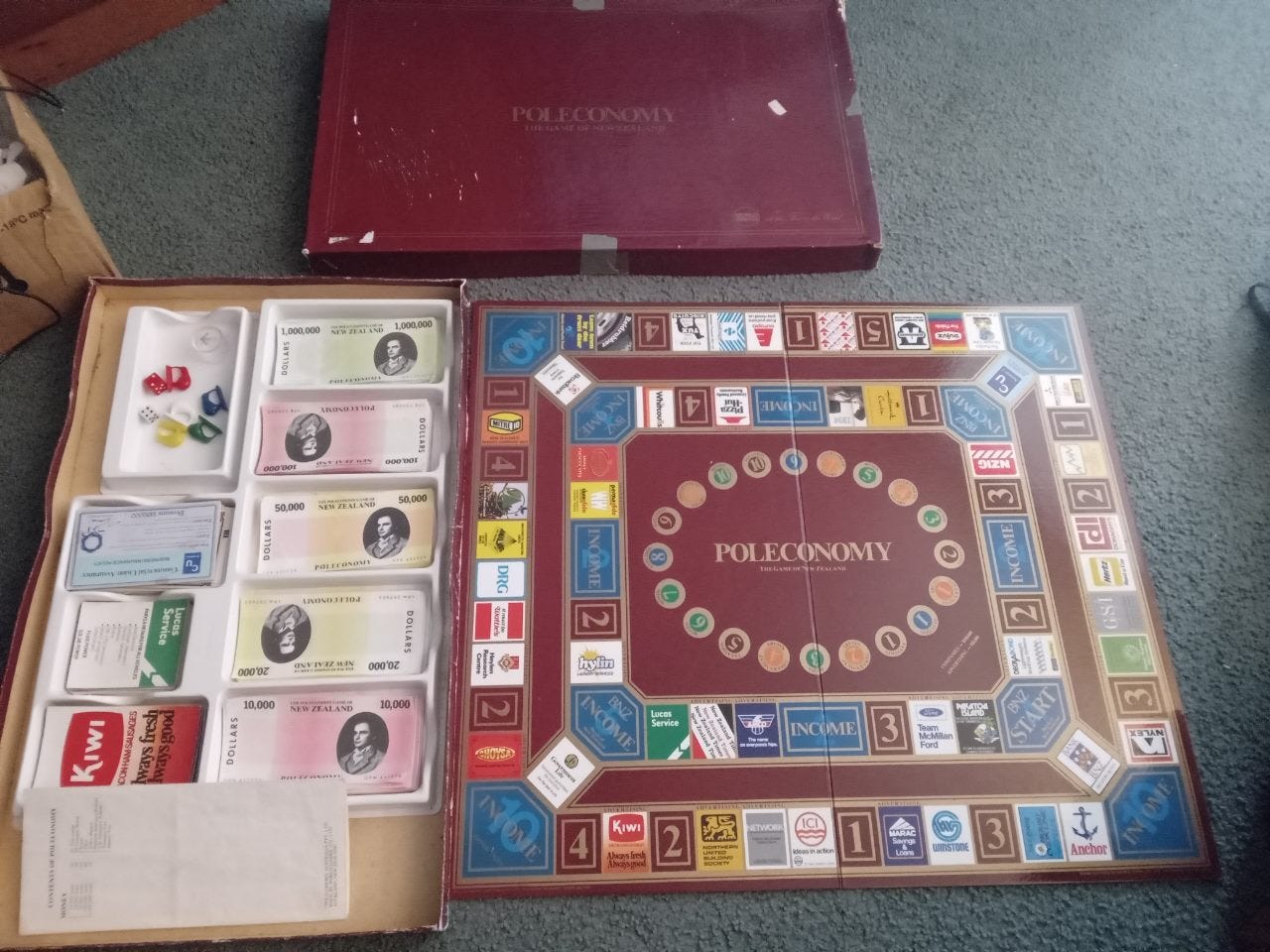

The family farm was auctioned on October 10. Nine days later was New Zealand’s Black Monday, when the stock market crashed. As an aside, as a kid we had a boardgame called Poleconomy, which featured New Zealand companies. I remember just how many of those companies collapsed after 1987.

I don’t know what happened to that game, but you can buy one on TradeMe for $52. I’m tempted, but I might stick to my Sharesies account.

I digress.

Anderson had bought the family farm off his parents for a nominal amount, and was farming it from the age of 21.

Wheat was grown on the property, about 800 tonnes a year, and he would also have a contract combine harvesting business.

The property had been rundown and needed new fences. Anderson needed money to pump into the farm and went offshore to secure a loan for $500,000, as interest rates in New Zealand were over 20%.

That loan was sourced via NZI (New Zealand Insurance), who he had paid to source the cheaper overseas loan.

But when the interest payments for that loan came due in July he found himself struggling to pay, “so I put (the farm) up for auction”.

“I probably could have stayed on the farm, but with interest rates like that I was haemorrhaging so much.”

That auction was later delayed until October 10, and NZI turned up to take over the auction

That property was effectively taken over, and sold via the bank for $745,000 which was $155,000 short of Anderson’s reserve.

“It was like a train wreck you were trying to control.”

Anderson believes that today that land would fetch around $50 million, given its proximity to a booming Wanaka.

The pensioner wants the farm back, and plans to continue farming until he no longer could.

“I’m not giving-up, I’m telling you right now.”

Last week Stuff reported how Anderson had take his case to the Supreme Court, with that May 31 decision noting “its sale has evidently caused Mr Anderson enduring upset”.

Anderson, who was self-represented, argued that he should be entitled to revive a struck out 1999 proceeding. He argued that was because he had been under the impression that the interim injunction from the 1987 judgment precluded anyone from touching his family farm property “until the court had looked into circumstances” associated with the first attempted mortgagee sale.

The Court of Appeal determined that the 1987 judgment, which led to an interim order as it was not properly served, did not have the effect asserted by Anderson, and “it expressly did not immunise” him from a further mortgagee sale should a demand be properly served.

But Anderson wasn’t giving up, confirming to Stuff that he had other legal avenues to pursue.

He maintained he wasn’t being vexatious, but had a legitimate claim.

Asked if he was after a settlement, Anderson replied: “No, I won’t take money for the farm”.

Instead his minimum would result in the payment of his creditors, which would work out to be about $3.8 million including interest: “I would walk away at that point.”

Anderson said while the bankruptcy meant he didn’t have to pay the creditors, “some of them were family friends”.

“We’re from Wanaka, a small community, and these are friends I owe money to, and companies who need the money.”

“I want my farm back. Yes, definitely. I’ll try and get it back as best I can. But the bottomline for me: the creditors.”

Anderson moved to Dunedin around 2000 to look after his elderly parents, who have both since died, and to keep himself occupied he studied at the University of Otago.

But just like his legal avenues, he found it hard to stop with his studies, leading to him study multiple papers, including law.

His long-running legal fight had cost him just $20,000.

You might remember last week’s piece concerning the University of Otago, and declining student numbers.

That led to a message from a person I cannot name, or where they work. But that person raises some interesting points. I don’t have time for a full story on this, but I do have time to list some of those points, which I have checked.

Has the downsizing in the university sector, including Otago, been driven by how accounting figures are interpreted rather than a real financial crisis?

If you want to see a spreadsheet of the financial data from the tertiary education sector, go here.

This spreadsheet runs to 2021, but don’t let that deter you, as Otago's 2022 financial statements are here.

We know this from Otago from the above:

2018 is $27m surplus and $104m operating cash flow

2019 is $43m and $88m

2020 is $26m and $121m

2021 is $17m and $97m

2022 is $15m deficit (or loss) and $51m.

My contact said to look at the depreciation expense, which was $82m in 2022 (see page 97 of Otago's 2022 Annual Report linked above).

Part of the issue is that Otago’s assets have bee revalued upwards, for example they were $995m in 2018 and $1,356m in 2022 (see page 121 of Otago's 2022 Annual Report).

So, what we have here are buildings being not only depreciated (declining in value), but also gaining value on the balance sheet!

Organisations could choose to value assets at historical cost, ie what they paid, but by using current value it results in higher depreciation, a large asset revaluation reserve, and surplus that doesn’t match operating cash flow.

Effectively, Otago has plenty of cash, they are just choosing to make staff redundant, raising the question as to why the university is using accounting figures like the corporate sector, and not the not-for-profit sector.

Operating cash flow is the most significant figure of that balance sheet, and Otago isn’t running out of cash.

Makes you think.

And I wasn’t surprised by the resignation of University of Otago Vice-Chancellor Professor David Murdoch, who has battled ill health.

All the best to him.

Interesting news about the Highlanders’ ownership, you can read about that here. But those new owners include Otago alumni Marc Ellis, Taine Randell, John Blaikie, John Timu and Simon Maling? Maybe my old rugby cards from the 1990s will now be worth something?

And if you know where the below photo was taken, let me know in comments.

Lastly, here is a track from former Dunedinite, Millie Lovelock, worth a listen:

Go the Nuggets!

You're the first person I know of who has also had Poleconomy! I still have mine, and I wonder how many are still floating around NZ. Whenever a friend was PM, she would boost the inflation to its maximum just to see what happened. I'm not sure what happened to her but am grateful she never pursued a career in politics.

Know it well...🍺🍻🍺